Redfin's Major Prediction: 2026 U.S. Housing Market Reset! Interest Rates Drop to 6%—These Areas Are the Best to Buy!

(Follow [Lianhong Immigration] for more updates LANHONG

Pioneered the promotion of U.S. EB-5 investment immigration in China in 2004)

For families planning to travel, study, or immigrate to the U.S., trends in the U.S. housing market are always a core topic. Before the "double pressure" of high mortgage rates and stubbornly high housing prices in 2025 has fully subsided, authoritative U.S. real estate platform Redfin has released its 2026 housing market forecast: a years-long "housing market reset" is about to begin.

Core Signal:

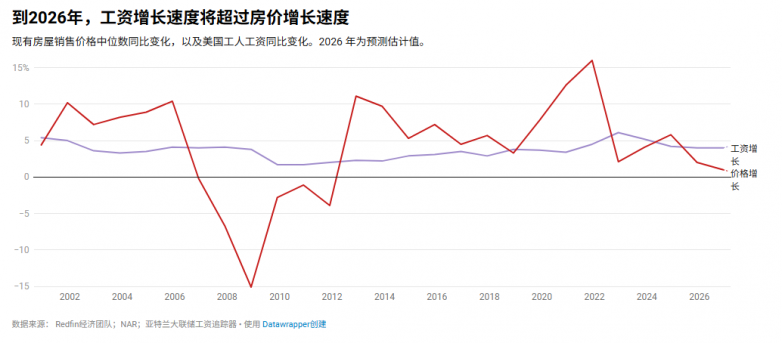

2026—First "Relief" in Housing Affordability

The key highlight of Redfin's prediction is the first occurrence since the financial crisis of "wage growth outpacing housing price growth." In 2026, the median U.S. home sales price will rise by only 1%, while wage growth will steadily lead. Combined with falling mortgage rates, the monthly expenditure pressure on homebuyers will be significantly eased. However, it’s important to note that this will be a "slow recovery"—sellers, holding substantial home equity, will be unwilling to sell at low prices, so housing prices will not plummet. The market will enter a balanced phase of "stable transaction volume and gradual price growth."

(Image: By 2026, wage growth will outpace housing price growthYear-over-year changes in the median existing home sales price and U.S. workers' wages. 2026 figures are forecast estimates.Data sources: Redfin Economic Team; NAR; Atlanta Fed Wage Tracker · Created with Datawrapper)

For families with immigration plans, this means a "window of opportunity to buy" is opening: there’s no need to chase high prices or rush to purchase properties. Instead, they can more calmly select properties based on the progress of their immigration applications. However, they must also be wary of local competition for high-quality properties due to limited supply.

8 Must-See Key Predictions:

Affecting Your Home Purchase, Investment, and Rental Decisions

Among Redfin's 10 major predictions, the following 8 are directly relevant to Chinese families' life plans. Lianhong Overseas provides in-depth interpretations combined with immigration business scenarios:

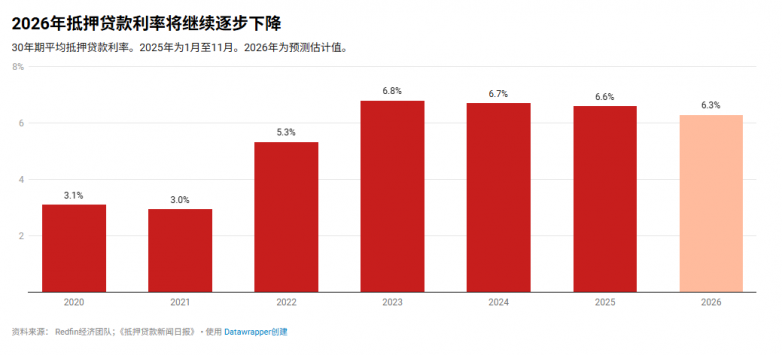

1. Mortgage Rates Fall to Around 6%, Repayment Pressure Significantly Reduced

In 2026, the average 30-year fixed mortgage rate will reach 6.3%, lower than 2025’s 6.6%. If the Federal Reserve’s interest rate cut pace exceeds expectations, it may even touch the 6% mark. For a $500,000 property with a 20% down payment, a drop in the mortgage rate from 6.6% to 6.3% would reduce the monthly repayment by approximately $80, saving nearly $1,000 annually.

(Image: Mortgage rates will continue to decline gradually in 2026Average 30-year mortgage rate. 2025 data covers January to November. 2026 figures are forecast estimates.Data sources: Redfin Economic Team; Mortgage News Daily · Created with Datawrapper)

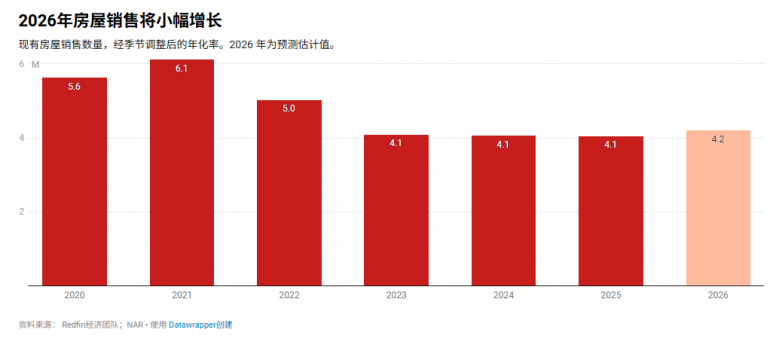

2. Sales Volume Rises by 3%, Spring Homebuying Season Becomes the "Golden Window"

In 2026, existing home sales will reach 4.2 million units, a year-over-year increase of 3%. The spring homebuying season will perform the strongest—at that time, interest rates will be 0.5 percentage points lower than the same period in 2025, attracting a large number of hesitant buyers to enter the market.

(Image: Home sales will increase slightly in 2026Number of existing home sales, seasonally adjusted annual rate. 2026 figures are forecast estimates.Data sources: Redfin Economic Team; NAR · Created with Datawrapper)

Immigrant families can focus on the spring homebuying season and prioritize areas with high employment stability (such as Silicon Valley, a hub for the tech industry, and Boston, which boasts abundant medical resources).

移民家庭可重点布局春季购房季,同时优先选择就业稳定性高的区域(如科技产业集聚的硅谷、医疗资源丰富的波士顿)。

3. Rents Rise by 2%-3%, Apartment Supply-Demand Imbalance Worsens

After the apartment construction boom in 2021-2022, new supply has dropped sharply. Meanwhile, high down payment requirements have led more people to choose renting, driving national rents up by 2%-3%. However, in immigrant-dense areas such as South Florida and Southern California, rental demand may be suppressed due to strengthened immigration enforcement.

Short-term U.S. residents (e.g., F1 students, those in the early stages of H-1B visas) can prioritize cities with more stable rental markets such as New York and Chicago. For those planning to settle long-term, "renting to cover the mortgage" remains an excellent strategy—especially for apartments near universities, where rental demand remains strong year-round.

4. Significant Regional Differentiation: New York Suburbs and Great Lakes Become New Hotspots

The 2026 housing market will show "uneven heating": New York suburbs (such as Long Island and Hudson Valley) will be favored by office workers for their convenient commutes, while the Great Lakes region (such as Cleveland and Minneapolis) will attract settlers with its low cost of living and climate safety. In contrast, "Zoom Towns" that thrived during the pandemic—such as Austin and Nashville—will see a muted market as remote work enthusiasm fades.

Most Likely Heating Up Real Estate Markets in 2026

New York City suburbs, including Long Island, Hudson Valley, northern New Jersey, and Fairfield County, Connecticut

San Antonio, Texas

Fort Lauderdale, Florida

West Palm Beach, Florida

Miami, Florida

Most Likely Cooling Down Real Estate Markets in 2026

Nashville, Tennessee

Syracuse, New York

Austin, Texas

Cleveland, Ohio

St. Louis, Missouri

Minneapolis, Minnesota

Madison, Wisconsin

EB-5 investors can focus on rural projects in New York suburbs, which not only align with policy preferences but also offer regional appreciation dividends. For study-abroad families considering "supporting education through property ownership," cost-effective properties in the Great Lakes region are more attractive.

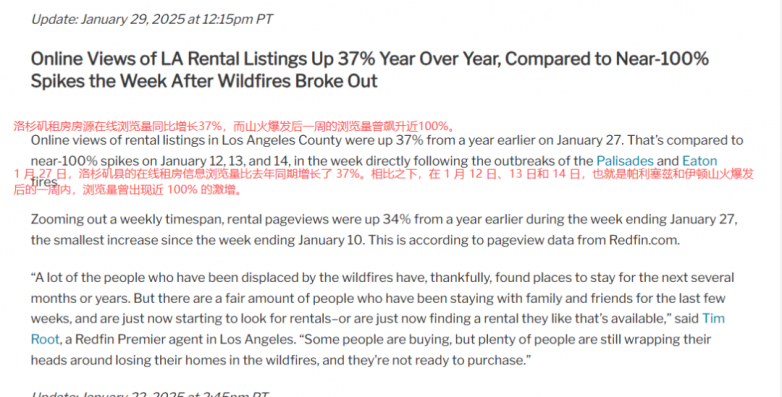

5. "Hyper-Localized" Climate Migration—Avoid High-Risk Areas When Buying a Home

Disasters such as hurricanes and wildfires have made climate a key factor in homebuying. However, people will not migrate across regions on a large scale; instead, they will move to low-risk areas within the same metropolitan area. For example, residents along Florida’s coast will relocate to inland suburbs, while Californians will avoid mountainous areas prone to wildfires.

Online Views of LA Rental Listings Up 37% Year Over Year, Compared to Near-100% Spikes the Week After Wildfires Broke Out

On January 27, online views of rental listings in Los Angeles County were up 37% from a year earlier. This contrasts with near-100% spikes on January 12, 13, and 14—directly following the outbreaks of the Palisades and Eaton wildfires.

Over a weekly timeframe, rental pageviews were up 34% from a year earlier during the week ending January 27—the smallest increase since the week ending January 10. This data is from Redfin.com.

"A lot of the people displaced by the wildfires have thankfully found places to stay for the next several months or years. But there are quite a few who have been staying with family and friends for the past few weeks and are just now starting to look for rentals—or just now finding a rental they like that’s available," said Tim Root, a Redfin Premier agent in Los Angeles. "Some people are buying, but many are still processing the loss of their homes in the wildfires and aren’t ready to purchase.")

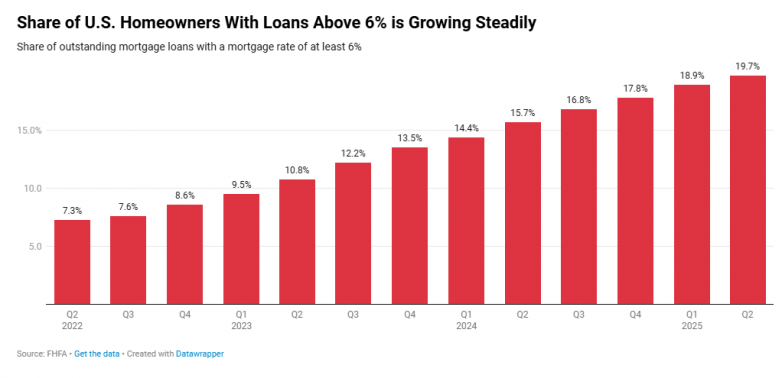

6. Refinancing Volume Surges by 30%—Existing Homeowners Can Reduce Costs

Approximately 20% of homeowners still hold mortgages with interest rates above 6%. In 2026, refinancing volume will reach $670 billion, a year-over-year increase of over 30%. For Chinese families who purchased homes in recent years, refinancing to lower monthly payments is a wise choice.

(Image: Share of U.S. Homeowners With Loans Above 6% is Growing Steadily Share of outstanding mortgage loans with a mortgage rate of at least 6%Source: FHFA · Get the data · Created with Data wrapper)

Refinancing requires valid identification and income documents. Families with green cards or work permits can apply directly. For families in the middle of immigration applications, it’s advisable to organize asset documents in advance to quickly initiate refinancing once their status is confirmed.

7. Policy Support: Bipartisan Efforts to Alleviate Housing Pressure

Housing costs have become a core concern for voters. President Trump may declare a national housing emergency, and both parties are expected to introduce policies such as down payment subsidies and tax breaks for first-time home buyers. Additionally, in 2026, the national conforming loan limit will be raised to $832,800, and up to $1,249,125 in high-cost areas—providing more loan flexibility for home buyers.

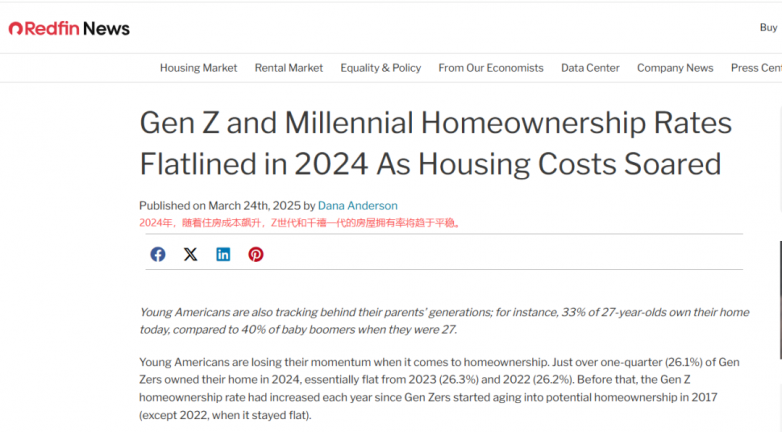

8. Young Families Struggle to Buy Homes—Renting and Co-Living Become Normal

Despite improved affordability, homeownership rates among Gen Z and millennials will remain stagnant. It’s estimated that 6% of households facing housing difficulties will live with parents or share rentals. High housing prices will further lower fertility rates. For families planning for their children’s long-term development in the U.S., securing permanent residency through programs like EB-5 in advance can pave the way for their children’s future home purchases.

The 2026 "reset" of the U.S. housing market essentially creates opportunities for rational homebuyers and long-term investors. For immigrant families, it’s crucial to closely align "immigration progress" with "housing market trends"—locking in mortgage rates during the decline, selecting the right properties amid regional differentiation, and seizing policy dividends during windows of opportunity. This way, they can achieve dual appreciation of "immigration status + assets."

Unique Advantages of Lianhong Immigration

Lianhong Immigration pioneered the promotion of U.S. investment immigration in 2004. The California Almond Farm project launched that year became an industry benchmark. Ms. Zou Lijuan, the founder and chairman of the company, organized China’s first investment immigration delegation to inspect almond farms in the U.S. in 2004, earning the title "China’s EB-5 Godfather." To date, the company has successfully promoted nearly 100 projects.

✅ Transforming immigration projects into high-return investments—an industry leader. We only cooperate directly with the most powerful and reputable local U.S. developers.✅ A 20-year document preparation team with extensive practical experience, helping thousands of families obtain permanent green cards.✅ Authoritative legal team: Professional lawyers led by Lincoln Stone, drafter of the EB-5 Investment Immigration Act, provide full-cycle services.

Lianhong Legal Team

|

Brandon Meyer |

Kate Kalmykov |

Bernard Wolfsdorf |

Lincoln Stone |

|

- Founder and Managing Partner of MLG |

- Senior Attorney at GT Law Firm |

- Former Chairman of the American Immigration Lawyers Association (AILA) |

- Drafter of the U.S. EB-5 Act |

|

- 24 years of outstanding experience in immigration law |

- Top EB-5 immigration attorney, co-founder of the EB-5 Immigration Alliance |

- Managing Partner of Wolfsdorf Rosenthal, a leading immigration law firm |

- Partner at Stone, Grzegorek and Gonzalez Law Firm |

|

- Ranked among the Top 25 Immigration Attorneys since 2014 |

- Member of AILA, with extensive experience in EB-5 investor applications and regional center applications |

- Served on AILA’s EB-5 Committee for over 20 years |

- 30+ years of legal experience, specializing in immigration cases |

|

- A respected and trusted authority in the EB-5 field |

- Winner of the 2015 U.S. Investment Forum "EB-5 Outstanding Contribution Award" |

- Featured in EB-5 Investor Magazine’s list of top EB-5 immigration attorneys |

- Served as Chairman of AILA’s U.S. EB-5 Investor Visa Committee for 5 years, recipient of two national awards from AILA |

Classic Project Review (2004-2011)

|

Year |

Project |

Details |

|

2004 |

California Fresno Almond Farm Project |

China’s first successful EB-5 project: 5x dividend, market value of $2 million. All investors obtained permanent green cards. |

|

2006 |

California Fresno Turkey Processing Plant |

Equity investment, 5-year term. All investors obtained I-829 permanent green cards. |

|

2007 |

South Carolina Power Plant Project |

Loan-based project, $500,000 investment, 5-year term, 1% annual return. All clients recovered principal, earned interest, and obtained I-829 permanent green cards. |

|

2007 |

California Fresno Machinery Processing Plant |

Loan-based project, first introduced to China by Lianhong. All EB-5 investors earned over $10,000 in annual interest, recovered $500,000 principal, and obtained I-829 permanent green cards upon maturity. |

|

2011 |

Los Angeles West Olympic Boulevard 901 Marriott Hotel Project |

Total investment of $168 million. Over 300 EB-5 investors participated. |

Classic Project Review (2012-2024)

|

Year |

Project |

Details |

|

2013 |

Water Park Near California Disneyland |

Exclusive agent: Lianhong Immigration. 1% annual return. |

|

2015 |

New York University Marriott Hotel Project |

Loan-based project. All investors’ I-526 applications were approved. |

|

2023 |

Seattle Seahawks Tower, Los Angeles Marriott Hotel, New York Empire Center OUTLET |

- |

Honors and Qualifications

AAA 级 Enterprise Integrity Rating (2023-2028)Issued by: Guangdong Provincial Immigration AssociationSupervised by: Guangdong Public Security Department Exit-Entry Administration Bureau

Vice President Unit of Guangdong Association for the Promotion of International Education (2023-2028)

Top 10 Preferred U.S. Immigration Brands (Awarded by Guangzhou Daily, December 2012)

China Internet Integrity Demonstration Enterprise (2015-2020)Evaluated jointly by: Ministry of Industry and Information Technology, Ministry of Commerce, State-owned Assets Supervision and Administration Commission, National Development and Reform Commission

Consultation Hotline: 4000-966-833

consultant

详情欢迎扫码咨询项目顾问

联鸿移民独特优势

联鸿移民2004年率先推介美国投资移民,2004年推出的加州杏仁农场项目,成为行业的标杆。公司创办人兼董事长邹丽娟女士2004年组建国内第一个投资移民考察团赴美国考察杏仁农场,被誉为“中国EB-5教父”。公司至今成功推介近100个项目。

✅ 将移民项目做成高回报的投资项目,业界翘楚,公司一直以来只与美国本土最有实力的信誉良好的开发商直接合作。

✅ 20年的文案团队,实操经验相当丰富,为上千家庭获得正式绿卡。

✅ 权威律师团队:投资移民法案起草人林肯为首的专业律师全程服务。

荣誉资质

咨询热线:4000-966-833